Before I got my first corporate job in stockbroking, I thought the way to become rich was simple. Work your way up to a high-paying job as a senior executive, and you’ll be rich.

In many ways, this is true, but also not. Just earning a high income does not create wealth and financial independence. Just look at the many high flyers that go bankrupt with excessive spending.

Over time, as I read more, learnt more, and invested more, I started to understand how real wealth is created. The fundamental framework is simple.

Let me help you understand this simple concept of how real wealth is created.

What you will learn

By reading this post, you will learn about

- What is capitalism and how it allows anyone to become wealthy

- Basic finance concepts of a Balance Sheet, Income Statement, Assets, Liabilities, Income, Expenses and Equity/Net Worth

- How the Balance Sheet and Income statements interact together

- Based on these concepts, an understanding of the secret to building wealth through asset accumulation

- Understanding what assets to accumulate to create wealth

Some of these concepts may seem dry, but it is the underlying mechanics of finance for business, stocks and also your own personal finances. These may be basic concepts, especially for those who know accounting, but it is so critical that I cannot avoid explaining it.

Let’s start with capitalism.

What is capitalism and why is it relevant to personal finances?

According to Cambridge Dictionary, capitalism is defined as “an economic and political system in which property, business, and industry are controlled by private owners rather than by the state, with the purpose of making a profit“.

The key concepts here are controlled by private owners and making a profit.

- Private ownership means individuals, or private entities (e.g. companies), are allowed to own assets. In historical times, everything would be owned by a “collective” or a government, not by individuals.

- Without the concept of “for-profit“, any additional gains could not be retained by the private individuals as owners of the assets which made the profits.

Now what does this have to do with your personal finances?

It has everything to do with personal finances.

Without private ownership, you will never be able to build personal wealth. You would never have the rights and freedom to accumulate money, and dispense of it as you so see fit. Your ownership of land, businesses and other assets can generate profits that you are allowed to keep.

This concept has allowed anyone to accumulate wealth to their heart’s desire, so long as they have the competency, motivation and knowledge to do so.

Your Personal Financial Statements: Balance Sheet and Income Statement

Financial Statements are documents that are typically used to track the financial performance and operations of a company, but they also apply to personal finance.

The two most relevant to personal finance are the Balance Sheet and the Income Statement (for the accounting geeks, we don’t need a cashflow statement as 99% of people won’t recognise income and expenses across different time periods).

What is a Balance Sheet?

A Balance Sheet is a snapshot of your wealth at a specific point in time, detailing what you own and what you owe.

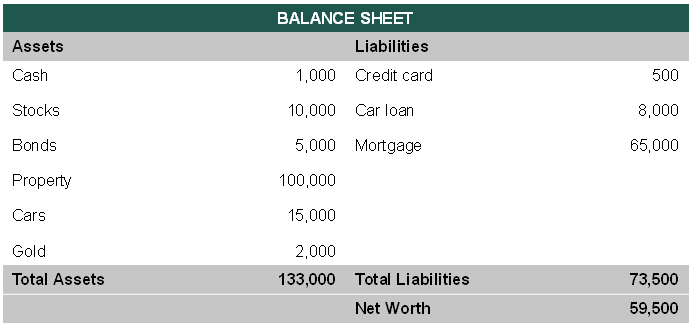

The picture below is a representation of what a Balance Sheet looks like:

So what are the key components of a Balance Sheet?

- Assets: This is basically anything you own, your private ownership as per the capitalist system. Money, cars, stocks, anything.

- Liabilities: Your debts and owings to others. Generally your home loan, car loan, credit card balance, and so on.

- Net Worth: How much of your assets belong to you, after paying back all your debts. This is how your net worth is generally measured, taking all your assets, minus all your liabilities.

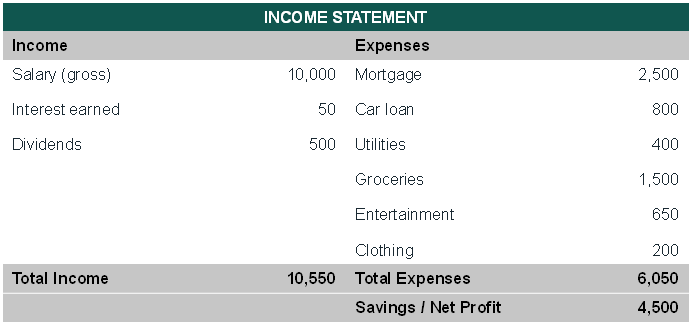

What is an Income Statement?

An Income Statement is a summary of all your income and expenses over a specific period, to calculate your “net profit” (income minus expenses).

For your personal finance statement, “net profit” would also be known as “savings”.

What is the relationship between the Balance Sheet and Income Statement?

A few general rules to remember:

1. Assets = Liabilities + Net worth, OR Net Worth = Assets – Liabilities

To increase your net worth (wealth), you have to either increase your assets or reduce your liabilities. It’s that simple.

2. Net profit / Savings = Income – Expenses

I think this is quite straightforward. Save more, spend less. These are the two sides of the budgeting equation.

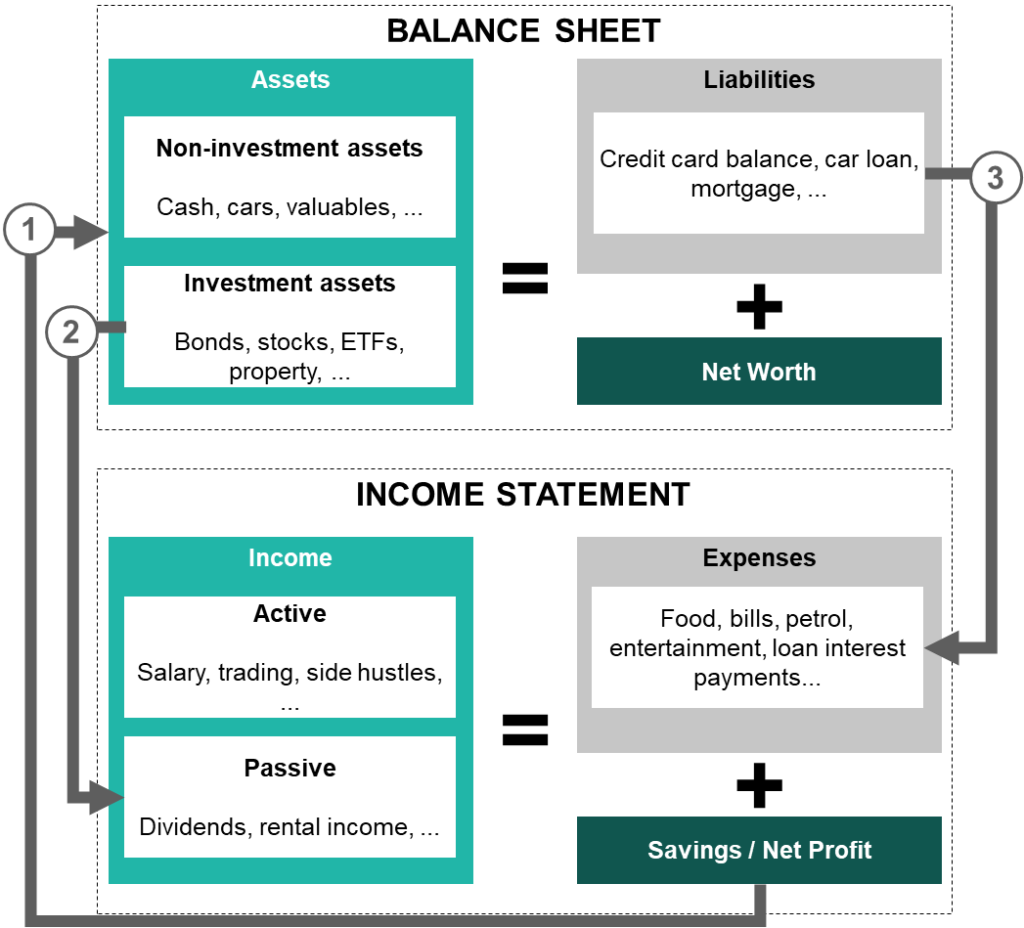

Now, have a look at the diagram below to see how the two statements are related:

What do you notice?

- First of all, your net profit, or savings, generally goes to increase your total assets by the same amount. This makes sense as what you save is stored in cash

- Second, investment assets either generate additional income or increase in value. Thus it helps increase your income and allows you to save more, or increase your assets, and therefore your net worth

- Third, when you have liabilities, you incur interest charges, which either increase expenses or liabilities. Either way, it decreases your savings rate and/or reduces your net worth

Are you starting to see the secret to wealth now?

The “secret” to creating lasting wealth and achieving financial independence

The “secret” is to grow your investment assets as much as possible through your savings / net profit, so that it helps you generate more income/asset value, which is a reinforcing cycle, growing your investment assets at an exponential rate. This is the simplistic concept of compounding returns.

The two key levers that pretty much determine how much wealth you accumulate are your

- Savings rate: Your savings rate is determined by how much income you earn versus how much you spend (arrow 1 in the above diagram); and

- Investment rate of return: How productive your investment assets (or total assets) are in generating income and capital appreciation based on how much money/capital you have invested (arrow 2 in the above diagram)

The less you spend now, the more you can put into investing. As your investment assets generate more value and income with a high investment return rate, you build significant wealth and ultimately financial independence. If you focus on these two levers, you will have accumulated enough investment assets where the returns are much more than your expenses.

And that is when you have the financial freedom to do anything you want in life.

What are investment assets?

Investment assets are assets that have the potential to increase in value (capital appreciation) or generate income over time.

For me, I define this as any financial instrument or vehicle that typically generates returns above the risk-free rate (which is the rate of return offered by Central banks). Most of the time, these would be stocks/equity and property. More nuanced instruments are bonds, mutual funds and ETFs.

Commodities, currencies and cryptocurrencies are not investments. These are “stores of value”, albeit many of them being poor mechanisms to do so.

Conclusion

Now you know the fundamental concepts of personal finance and how anyone can create wealth for themselves. Everything really boils down to the two key drivers of your savings rate and rate of return on your investments.

Simple, right? But not actually easy in reality. Just having the knowledge is not enough. Else everyone would be wealthy. The real challenge is building the right financial mindset for long-term wealth creation and preservation.

Money psychology is 80% of the game. And that’s the real secret meta.

So what’s next? Now you know how to create wealth, you need a financial plan to strategise how to get there (and help keep your mind focused on the prize).

Don’t know what is a financial plan? Click here to read my next post and learn about financial plans.