When I first started my first job in stockbroking, I was excited. I was working with clients, executing their orders, and watching the stock market every day.

I dabbled in a few stocks myself, but never really made much money. Also, I never had an idea of how I should structure my investment portfolio, or how I would build wealth.

That all changed when I completed my RG146 license in Australia as a part of my job. I learned about financial planning and applied it to my own personal finances.

Since then, my net worth has increased considerably, and I give a lot of that credit to having my own personal financial plan.

What is a financial plan? Simply put, it is a document describing your financial goals, current financial situation, and steps to take to achieve your financial goals.

Why do I need a financial plan?

Creating a financial plan is one of the first steps to take in your journey to financial independence. Why is having a financial plan so important?

- You will have a structured process to achieve your goals

- It keeps you focused on your goals and investment strategy so you don’t get distracted by the next sexy investment fad

- You get a clear picture of your current financial situation and perspectives on money

- By writing it down, you are able to spot any gaps in your financial plan

- It can be used as a tool to discuss finances with your life partner, financial advisor, estate lawyer, and other relevant people

Unfortunately, not many people have a financial plan. Some may have a few financial goals written down, but a financial plan is more than that.

It is a holistic action plan that covers how to achieve those goals, investment strategies and steps to minimise risk.

I think the reason many people don’t have a financial plan is because there isn’t much information easily available on the subject. Whatever available information is quite generic, which makes it difficult to know how to develop a financial plan by themselves. (The other reason is that it also takes time and effort to develop a financial plan).

This is also what you’d normally pay financial advisors to do, so they’re likely not going to share their secrets and methodologies.

So I’m going to demystify financial plans, tell you what’s inside a financial plan, and how you can do it yourself. In detail. All for free.

Because everyone needs a financial plan.

What will I learn about financial plans in this post?

In this post, you will learn the “secrets” of what goes into a financial plan. I will also provide some information on what type of content goes into each section of a financial plan, and how it all fits together.

In future posts (which I’ll link to here), I’ll provide more detail on each section of a financial plan, as well as how to take action (e.g. how to write down your financial goals).

What does a comprehensive financial plan include/cover?

1. Goals

This is the backbone of your financial plan. All other aspects of the financial plan are built based on what financial goals you have for yourself and your family.

Your goals can be anything that you want it to be. You can choose to dream big if you want to. Examples of goals are:

- Retiring at 45

- Financial university education for 2 children

- Buying a house at 30

- Having 2 vacations a year

- Founding a charity organisation

Click here for my post on how to set SMART financial goals

2. Net Worth

Your current net worth is the starting point in your financial independence journey. When compared against the goals you want to achieve, you have an idea if your journey requires a hundred steps or a million steps.

Identifying your net worth is simply adding up all your assets, minus all your liabilities. There are arguments for/against including certain types of assets like the property you live in, cars, jewellery, and so on. I’ll cover my recommended approach to calculating net worth in a more detailed post.

Over the course of implementing your financial plan, you will be tracking and updating your net worth figures periodically. Tracking your net worth is the typical way to track if you’re hitting your goals.

3. Budget

A budget is your plan on how you use your income, whether it is to buy necessities, save for a rainy day, invest, or anything you want.

The aim of any budget is to ensure that you never spend more than you earn. Also, a great budget involves having a healthy balance across necessities, savings, investing and personal spending.

Your budget should also account for infrequent and large expenditures, and have buffers to ensure there is a margin of error for unexpected expenses.

4. Investment Policy Statement (IPS)

An Investment Policy Statement is a statement or document that describes your investment plan. You will have more clarity and focus on your investment strategy if you actually write down your investment plan.

A typical IPS contains investment objectives, risk tolerance, asset allocation, and liquidity needs. This is not an exhaustive list, and it can even be more detailed to list down even more considerations when you invest (e.g. selection criteria, investments selected, withdrawal strategy)

5. Forecast cashflow / Net worth

This is where you estimate how much you would have saved, invested, spent, and what your net worth would be in the future. This would be based on your budget to give an indication of your estimated savings and investment amounts.

Forecasting your future net worth will allow you to estimate if your planned budget and investment strategies are sufficient to meet your desired goals in your expected timeframe, and adjust as necessary.

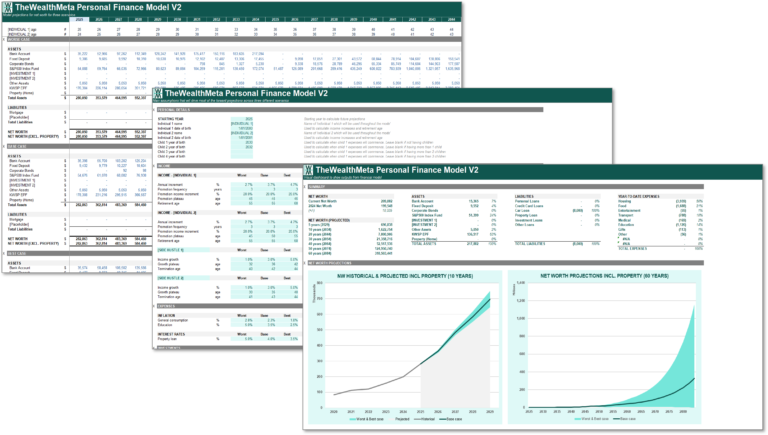

Click here to access TheWealthMeta’s Personal Financial Model V2 Excel template

6. Insurance

Everyone needs insurance to manage risk.

As part of a financial plan, insurance provides a safety net allowing you to still achieve your goals even if misfortune should happen to you. It will also allow you to weather any unforeseen significant expenses that may typically bankrupt you

Everyone thinks that they never need insurance until it’s too late.

7. Estate / legacy planning

You don’t want all your hard work to go to waste, do you? You’ve accumulated wealth, and you need to make sure that if you’re no longer around, your assets are distributed according to your wishes.

For some, especially with businesses, you’ll also want to consider succession planning. Who takes over the family business once you’re gone / retired? What steps do you need to implement your succession planning?

8. Additional content

- Education – Depending on how much planning you need to do for your children’s education, it can be worthwhile to calculate the detailed costs. For example, private schools and tertiary education can, not even accounting for extra-curricular activities. Also, education inflation is different from the usual inflation rate

- Tax – For some, it may be useful to actually plan how to minimise tax. This may or may not be useful for your situation.

- Retirement plan – Depending on your retirement goals and investment strategy, you may want to list out in greater detail how you will transition to retirement, and what financial considerations to consider during retirement.

Frequently Asked Questions

This sounds incredibly complex!

Sure, you can always simplify it. It is your financial plan. I’m trying to give as much information as possible, but also balance that with what’s practical.

This seems like too much work!

That’s why you pay professionals a fee to do work for you. Something that is greatly underappreciated.

Do I really need one?

That’s entirely up to you. But you know the FIRE movement? Aside from the concept of retiring early, I’m confident that its appeal is because it is, at its core, a very simple financial plan. Example: Build enough wealth for a 4% withdrawal rate through index funds to retire early at 40 years old. How is that for a clear and simple financial plan?

Bonus: Sample Financial Plan

Unless you’ve hired a financial planner, chances are you haven’t seen what a financial plan looks like.

Curious to see what a financial plan actually looks like? I’ll let you download a copy of it. I have removed sensitive data and numbers in it for anonymity, but other than that, it is what I genuinely created myself. It doesn’t show all the analysis and number crunching that’s in an Excel file though. That may come later.

Click here to download a PDF copy of my financial plan.

Conclusion

Everyone needs to have a financial plan, in some shape or form.

In future posts, I’ll go in-depth into each section of a financial plan, so you know how to create your own financial plan.

But before even starting to develop a financial plan, you need to start tracking your finances. Read on for making a habit of tracking your finances and 5 reasons why it matters, and then how to go about tracking your finances [post coming soon]