Salary Series Part 1: Unpacking the challenges in Malaysia

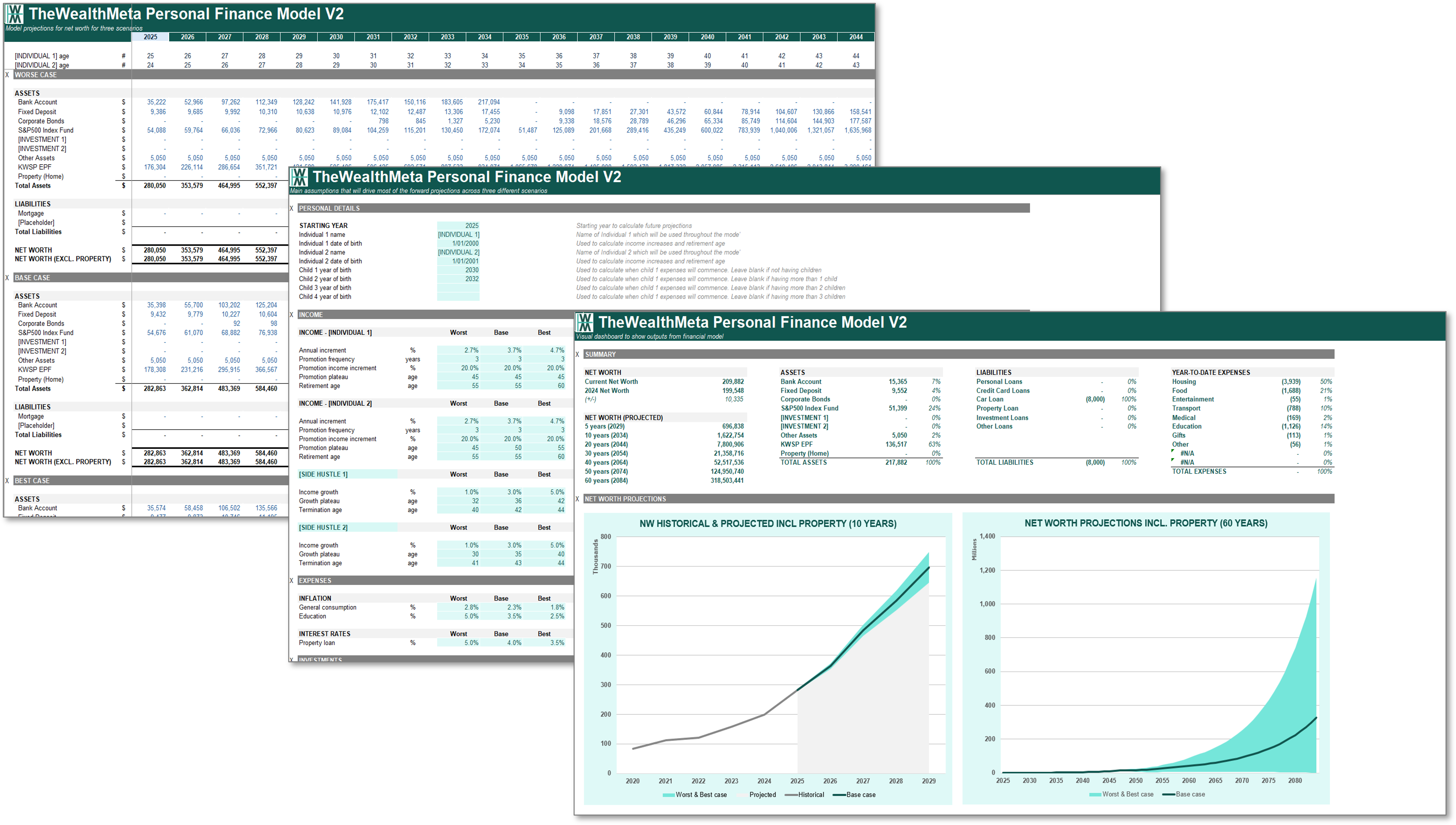

“It is not the employer who pays the wages. Employers only handle the money. It is the customer who pays the wages.” Henry Ford Key Takeaways Salaries in Malaysia are growing; however, they remain low relative to developed markets Salaries are determined based on the supply vs demand for labour, in addition to the effectiveness of matching supply and demand Impediments to improved salary growth in Malaysia are mainly due to structural reasons in our economy and country: Oversupply of…