In my previous post, I wrote about calculating how much you need to save/invest based on your SMART goals. In this post, I want to cover how you use those expenses, savings and investment targets to form a budget. As you start to form a budget, you also need to link it to your actual income. If you’re not earning enough currently, what do you do? This post will hopefully join those dots together and help you figure out the right balance.

What you will learn in this post

- Common budgeting methods / systems (and why you should develop your own customised budget)

- How to combine what you have learnt so far to develop your own customised budget

- What to do if your current income is incompatible with your financial goals (Finding the right balance between saving/investing for the future and immediate spending)

- Advanced techniques to think about your budget and cash flow which you may not have read elsewhere (some may only be applicable to Malaysians)

What are common budget methods/systems? Which one do I recommend?

If you’ve read my writings, you likely already know what is a budget. You’ll also know why it’s important for most people unless you’re earning a 7 figure salary (actually, even then it’s still important to keep those luxury expenses “in check”).

I’m sure you’re also aware that there are many, many different budgeting methods out there, for example:

- Traditional budget: This is the old-school way of deciding your own categories, and then setting spending goals / limits for each category. This is for the detail oriented person who wants to nitpick down to bulk ordering toilet paper

- 50/30/20: This might be the budget which most people are aware of. From your income, 50% goes to needs, 30% to wants, and 20% to savings. This is a simple budget designed to give you flexibility

- 80/20: Even more simplified, where 80% is for spending however you want, and 20% is saved

- Conscious spending plan: My personal favourite. Developed by Ramit Sethi of “I will teach you to be rich” fame (part of my recommended reading list). You can read more and see his video on what is a conscious spending plan here. I like it because

- There are specific allocations of money to Both savings and investments and savings

- He suggests a range of percentages, so you have some flexibility for each category

- Through his many podcasts with real live couples, he has shown how it can be used across many different circumstances

Which budgeting method should I choose?

There is no right answer, just pick one and start (taking action is more important). Starting will help you build the right habits and understand your preferred style of budgeting and tracking.

As you gain experience and your financial situation becomes more complex, you might find that these methods may either:

- Not work out for you;

- Not apply to your personal situation; or

- Be too restrictive

Why? Because

- They’re cookie-cutter: They’re designed to be generic and applicable to cover a broad range of scenarios and people. Many of the methods were likely invented by people from the USA. Your needs and circumstances will likely be different. It still needs to be customised to your personal circumstances and financial goals. They’re meant to be a general framework and starting point for you to build upon

- For example, someone who wants to FIRE will need to save more than the typical budget allocated for savings and investments

- They’re not linked to your goals: using a budget that just says to put 20% of your income to savings but doesn’t tell you when and how you’ll hit your financial goals

So what do I recommend?

The ideal budgeting method for you is your own customised budget that you will be able to iterate and sustain for years or even decades. I suggest

- Starting with any one of the budgeting methods that I listed (or any other you’ve heard of)

- Follow that for some time, say 6-12 months

- Note down what works or isn’t working

- As you get more experience and your situations change, start tweaking the budgeting method to work for you

- If you’re ready, create your own fully customised budgeting method

- Continuously review and refine

When you start customising a budget, I recommend starting with the big 4 allocation buckets I wrote about in the previous post:

- Monthly expenses

- Lumpy expenses

- Savings

- Long-term goals

If you recall my previous post about SMART financial goals I explained how financial goals determine your saving and investment targets (and depending on your financial goals, your monthly and lumpy expense targets).

To complete the spending/cost portion of the budget, you’ll need to come up with monthly and lumpy expense targets.

How much should I allocate for monthly and lumpy expenses?

You’ve been tracking your expenses, right? If not, you should start now.

- Look for the monthly average for your typical expenses. That’s your monthly expenses

- Search through your last year’s expenses for anything that you need to pay for periodically, but not monthly. Add them all together and divide it by 12 months. That’s your lumpy expenses that you put aside monthly in a separate account

- Once you’ve determined those two numbers, I recommend adding a 10-20% buffer for unforeseen expenses. Events, gifts, accidents, and other situations always come up from time to time.

Also, don’t forget to allocate some money for your spending pleasures.

Comparing your budget against your income

Now that you have a monthly budget, you need to compare it with your monthly income. This typically includes

- Salary from full-time or part-time employment; and

- Stable / predicable income from side-hustles

Refer to the FAQ section further below for information on how to handle irregular income (e.g. royalties, gig-work, freelance) and income from investments.

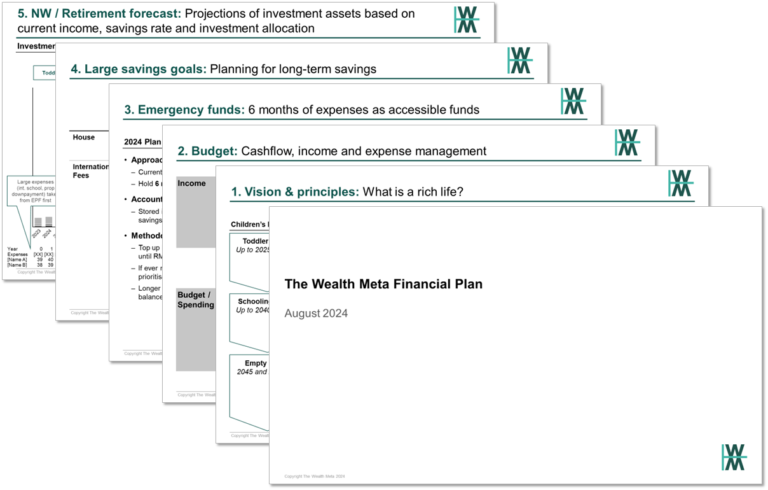

So now you have the key categories of your budget as summarised below.

- Your monthly / lumpy expenses, as mentioned above

- Your monthly savings and investment targets, derived from your financial goals; and also

- Your income, which you can get the key information from your payslip (and other sources of income that you get consistently)

Ideally, your total income should be more than your expenses and savings/investment targets combined. If that’s the case, great! You have extra money to allocate however you like depending on your priorities. For example, if you don’t have a 6 month emergency fund built up, you should definitely focus on that first.

What if my income is not enough for my monthly expenses, savings and investment goals?

The best way is to earn find ways to earn more money, however, this will take some time. In the meantime, the immediate solutions would be to:

- Reduce your monthly expenses, by cutting some spending in non-essentials or cheaper essential spending (there are millions of articles out there on how to do this)

- Revisit your financial goals to reduce the monthly savings / investments targets (at least until you’re in a better position to dream bigger)

There is no right answer; it’s a matter of choosing what you value more, and what can you live without. To help with making that decision, think about your preference in prioritising:

- Immediate needs vs wants – Basically what is essential and non-essential. You need a car, but is that new BMW really needed, or could you live with a second hand Honda?

- Future versus immediate spending – As a rule of thumb, immediate needs should always be the first priority, followed by a healthy balance between immediate wants (not too much) and future needs, and lastly future wants

- Time/effort to hit goals – Could you put off that holiday for another 6 months? Do you hate working so much that you want to retire as early as possible? Longer time frames and more delayed gratification ease the amount that you need to put aside for those goals each month/year

Two key things to take note when budgeting

- Do experiment and understand when certain budgeting principles/rule can be broken

- For example, if you’re aiming for CoastFIRE, once you’ve achieved your CoastFIRE goal, you don’t need to put aside money for investments any longer

- You will likely iterate / adjust over time depending on your life stage and circumstances

- For example, unforeseen circumstances like a huge promotion and pay bump, or having kids can significantly change your budget

What are some next meta concepts to take my budgeting to the next level?

- Consider annual rather than monthly budgets – Switching to an annual budget enables big picture thinking. You’ll start thinking about your finances in much bigger numbers, which elevates how you think about money, leading to more wealth acceleration. It also starts making budgeting simpler. For example, lumpy expenses and monthly expenses become consolidated into one category

- Use gross salary and expenses, not “net / take home” – It is quite common to budget and examine your finances using the amount of money that you see deposited in your bank account at the end of the month. I suggest actually looking at gross amounts, meaning prior to any deductions, such as taxes, student loan repayments, contributions to retirement funds, etc. Why? Because you then have the whole picture and understand there are so many more levers/opportunities to increase your wealth.

- You have visibility of how much tax you’re paying and start to think about how you can reduce/optimise tax expenses through tax deductions and reliefs

- You’ll start looking into advanced strategies to maximise retirement plan contributions that apply to you in your country

- You can better negotiate compensation packages with employers, for example negotiating higher employer retirement contributions if the hiring manager is unable to budget on the base compensation offer (Malaysia-specific context: you could negotiate for a higher Employer EPF contribution, above the 12-13%. Up to 19% is tax-free for employers. Many companies pay more than the statutory minimum)

- Automate your budget and expense tracking – The more you automate your finances (and your life), the more effort time you free up to focus on more important aspects of personal finance or other areas of your life

- Think about gifting or giving to others – Being generous to others helps with growing a mindset of abundance. You’ll see this mindset as a common theme across highly affluent and successful people. Even if you don’t have much to spare, there any many social impact areas which accept very small donations

- Start thinking about future changes to your budget – A budget isn’t permanent over your lifetime. Things change over time. When you have kids, medical expenses, housing, etc. The better you can anticipate and plan for it, the fewer unwanted surprises in your finances.

Frequently Asked Questions

How often should I review my budget?

I suggest annually. If you’ve been tracking your actual expenses, you will have a years’ worth of recent expenses to set a reasonably accurate budget for next year

How do I ensure I stick to my budget?

The obvious things are paying yourself first, automate, envelope system, etc. If you’re still struggling to meet your targets after all these tactics, then you really need to have an honest reflection on the targets you’ve set. Are they realistic? If it’s a yes and you’re still struggling, then maybe they aren’t actually accurate. You might need to make a call and realise that your savjngs/investment targets will have to be adjusted downwards. If that’s not incentive enough for you to save for the future, then nothing will. It just honestly says you prioritise immediate needs and wants vs the future. And sometimes, there’s nothing wrong with that

Should I include all the income I get from dividends and property, e.g. Passive or investment income?

I wouldn’t include it in a budget until you’re in the wealth distribution phase (a.k.a. Retirement). The reason for this is that it’s best to maximise investment returns by reinvesting all dividends, distribution and interest, maximising the compounding returns benefit

My income is irregular because I’m a freelancer / my royalties are inconsistent. How do I budget?

Annual budgeting will help you significantly. Your monthly income might be quite erratic, but it’s likely that your income on an annual basis shouldn’t be as volatile.

Even if it still is, i suggest taking a conservative approach such as taking the lowest annual income from the past 3 years as the baseline for annual income going forward. This ensures that you’re able to manage times when you’re earning less.

Conclusion

By now you should be comfortable in creating your own budget. As I talked about previously, we haven’t considered inflation and how much our savings and investment grow over time, which should make achieving our financial goals so much easier.

I’ll cover these in my next few posts, about forecasting future cash flows and net worth, as well as incorporating inflation and investment return rates as key assumptions.