Simple can be harder than complex. You have to get your thinking clean to make it simple

Steve Jobs

Key Takeaways

- The overwhelming majority of investors are best served by a simple and boring Boglehead portfolio, consisting of just 1-3 broad-based market index funds

- A simple and boring portfolio provides a near-guaranteed 10-12% annual return in the long-term, for virtually zero effort

- Chasing alpha through individual stock picking or excessive diversification increases decision fatigue, raises the risk of errors, and is highly unlikely to beat the simple index fund in the long run

1. Simplicity is the ultimate sophistication

In 1985, Steve Jobs was ousted from Apple. He had lost the war to stay in the company he founded, and was forced to resign.

Over the next 8 years, Apple started to flounder. The IBM-Microsoft desktop strategy dominated with over 90% market share. Apple developed new models inside each product line, as well as ventured into entirely new product lines. Nothing seemed to work to reverse its decline, and Apple was on the verge of bankruptcy.

Then, through a twist of fate, Steve Jobs returned as the CEO of Apple (through the acquisition of NeXT, a company he founded).

He conducted a full audit of every single product. Teams had to justify the existence of their products and projects. He ruthlessly cut underperforming and complicated products, as there were too many different products and models. Soon, he had cut about 70% of all Apple models and products. It was slash and burn.

Steve Jobs was a master of focus and simplicity. “Deciding what NOT to do is as important as deciding what to do”.

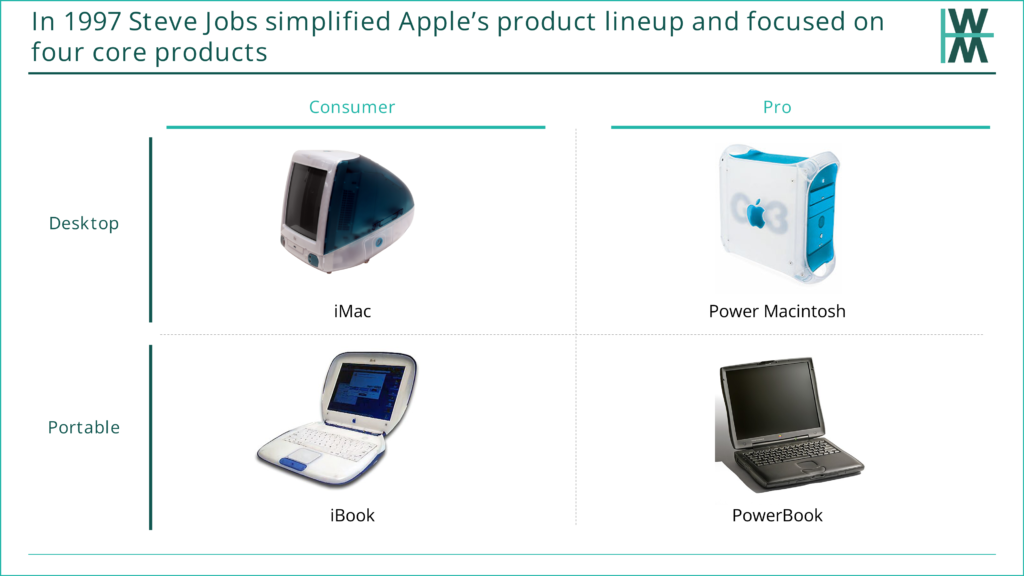

It wasn’t enough. Weeks later, he was still stuck in meetings, discussing what products to retain and which to cut. He was sick of it. In one meeting, he interrupted the presenter and shouted, “Stop! This is crazy”. He walked to a whiteboard and drew a 2×2 diagram:

“Here’s what we need”, he said.

He effectively eliminated everything, started from scratch, and decided to develop only four products. This focus on simplification saved Apple. By the next year, Apple had turned its fortunes from major losses to a $309 million profit.

There’s an elegance to this simplicity which also extends to the world of personal finance. Currently, there are many, many types of investments available and individual stocks to purchase. The excessive amount of choices makes the world of investing seem complicated and overwhelms most people.

Does the average investor need to be holding 50 different assets in their portfolio? How does an individual keep track and actively manage the performance of each investment?

Is there a better, more efficient, and simpler way to invest that provides excellent returns without having to be a finance guru?

There is.

2. What’s in my simple portfolio vs “social media portfolios”

If it’s not obvious already, I’m a Boglehead investor. I love broad-based market index funds. More on my investing philosophy in my 21 principles of personal finance.

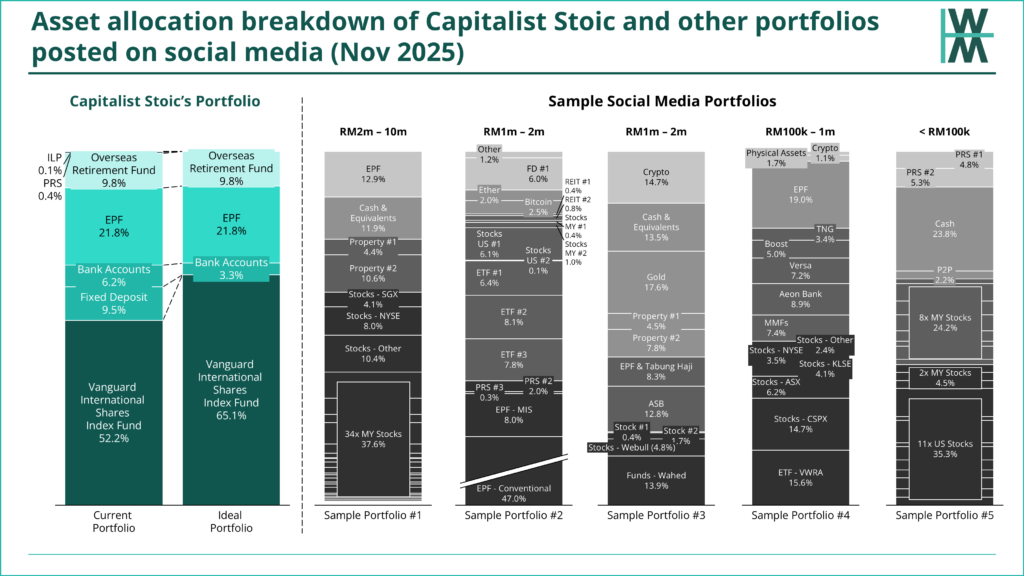

So, what makes up my portfolio of assets? See below. Let’s also compare my portfolio to typical asset portfolios that have been shared on social media (which have detailed information on their asset allocations).

On the left is my current portfolio of assets. Next to it (the second bar on the left) is my “ideal asset portfolio”, if I could actually streamline it.

Unfortunately, I’m stuck with PRS as part of my past employment at a bank, and the ILP is there for personal reasons (most of the balance is withdrawn). The current large cash balance and fixed deposit will be reduced substantially after my large expenses in the coming 12 months are complete, such as my subsale property purchase.

Essentially, my assets are anchored around 4-5 “investments”. That’s it.

Do you see the difference between my portfolio and the “social media portfolios”?

“Social media portfolios” have many more asset classes, and within each category… many, many accounts/stocks/ETFs/REITs.

I believe that a simple yet boring Boglehead portfolio consisting of only 1-3 broad-based index funds provides superior returns over the long term (20, 30, 40+ years and more).

3. The rationale for a simple and boring Boglehead asset allocation

3.1 Superior term returns for the average investor

If your investment portfolio resembles the “social media portfolio” with individual stocks and other actively picked investments, you should take a hard look at its performance. Are you beating 10-12% annual returns? No cherry picking winners like Tesla or NVIDIA. You also need to include all the losers.

Even if you’re the outlier earning above 15% returns, how confident are you in sustaining that rate of return by making thousands of small buy/sell decisions over the next 40 years?

I would say it’s extremely unlikely. You’d have to make hundreds and thousands of “correct” investment decisions over the course of your lifetime. And spend hundreds and thousands of hours managing the portfolio. Why take such a gamble? Even professional hedge funds lost a bet against Warren Buffett and couldn’t beat the S&P 500. Do you think you can fare much better?

With a Boglehead investment approach, you only need to make one investment decision. One decision which lasts for the rest of your life (unless you want to rebalance the bond/equity ratio as you reach retirement).

With this one simple yet boring decision, it’s just too easy to make a “guaranteed” ~10-12% returns for the rest of your life (based on 100 years of data). No further analysis required.

Morgan Housel said it best that it’s not about “earning the highest rate of return”, but about “what are the best returns I can sustain for the longest period of time?”.

3.2 Extremely low maintenance

Even for those that manage to generate some alpha above 12% p.a. returns (with questionable long-term sustainability), at what cost? The simple (Boglehead) investment strategy needs virtually zero effort. No buying or selling decisions. No stock picking. No analysis needed. Just keep 12 months of emergency savings, and everything else goes into the Vanguard World Fund (or similar broad-based market index fund). I don’t need 20 different stocks, 5 money-market funds and 3 high-interest savings accounts in an attempt to maximise and diversify my portfolio.

Complexity comes at the cost of increased risk of errors and decision fatigue.

3.3 Keeps me focused on my investment strategy

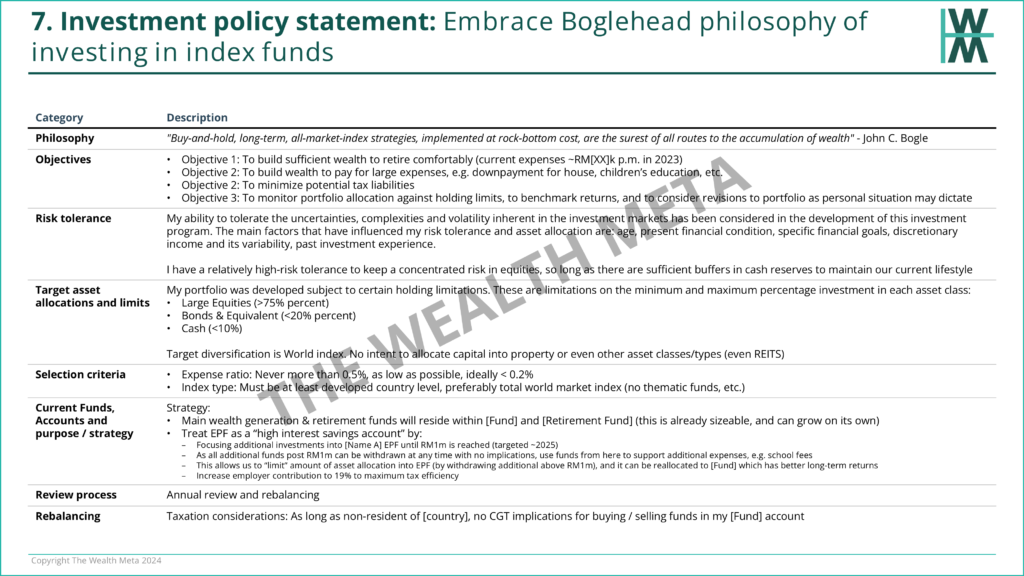

The simple and boring portfolio aligns with my financial strategies outlined in my investment policy.

My investment policy is one component of my financial plan, as shown below:

Once I start dabbling in individual stocks and other asset classes which are not aligned with my investment policy, my financial plan is at risk of going off course.

My focus on such a simple yet focused portfolio keeps me confident that I can hit my financial goals in the timeframes I forecast.

Because having a strategy is about making choices, prioritising what is important, and more importantly, making a conscious choice in what I am NOT doing /investing in.

Doing a bit of everything is not a strategy.

3.4 There’s more than enough diversification in a World Equity Index Fund

My industry and geographical diversification span the whole world. That’s good enough for me. My EPF accounts then serve as my bond allocation. I don’t need property, don’t need Bitcoin, and don’t need commodities.

3.5 Easier estate planning and execution

When you have 15 different bank accounts, 3 eWallets and 5 brokerage accounts, with stocks and ETFs, crypto, and property all over the place, it’s going to be a lot of effort to manage your estate. For me, my family will only need to manage 1-2 investment holdings if I’m gone.

4. Typical arguments against portfolio simplicity

4.1 Potentially missing out on the next NVIDIA or Bitcoin

My investments, which are mostly in a Vanguard World Fund, generate ~10% p.a. returns (even higher in recent years). This return is pretty much a certainty for ZERO effort. From a risk-and-effort-adjusted basis, no other asset class can provide that level of return certainty over multiple decades.

Commodities, property, and other asset classes either have long-term returns significantly below equities, or questionable risk profiles or are still unproven/immature.

Single stock equity investment requires significant effort to generate a questionable level of alpha, with a very low level of confidence.

4.2 It’s too concentrated on equities

A simple equity/bond allocation portfolio works just fine. EPF serves as the bond component. Hundreds of thousands of Bogleheads, research and articles have shown that a simple portfolio works just fine, and is likely superior to anything else out there.

4.3 Missing out on the tax reliefs from PRS and SSPN

Agree, but it’s at the expense of better long-term returns. Even with tax reliefs, a World or S&P500 index fund is a far superior investment in the long term. I’ve done the maths.

4.4 There’s nothing wrong with putting a 5-10% allocation to speculative or high-risk investments to scratch the itch

Sure. If you have an investment policy and/or financial plan to guide how you invest, then sure. Have you written down in a financial plan that speculative investments will comprise no more than 5% of your portfolio?

Many investors have large asset allocations of more than 5-10% of their portfolio in individual stocks, speculative high-risk investments or other investments that require active management.

It’s a slippery slope to say “I’ll put no more than 5% in play money”, which then unknowingly becomes 50% of your investments over time when you listen to more and more noise.

If you can’t sit still and have an itch to scratch, consider finding a hobby or reading some books on personal finance.

4.5 It’s risky to put all your capital in one investment with one broker

Not true. Stick with regulated brokers or go direct to the Fund Manager. Many people hold USD 7-8 figures in one investment account (see Bogleheads forum). What’s the risk? For direct US accounts, you may want to be aware of the estate tax, but that’s a different issue, and there are alternatives now available in Malaysia.

4.6 You should diversify away from centralised assets in case governments or capitalism fail (and into gold, crypto and other stores of value)

If governments/countries and the world fail, there are larger problems at hand. And there’s no guarantee that in that post-apocalyptic world, that gold, crypto or whatever asset you held is the bartering currency of choice. (I might then consider hoarding bottle caps).

5. Why is the average investor’s portfolio usually more “complex”?

- Malaysian accessibility to index funds is relatively new – Even 10 years ago, it was difficult to access broad-based market index funds in Malaysia. Most Malaysians have never even heard of index funds. Thanks to social media, the FIRE movement and more online brokers providing access to international markets, there is now a lot more awareness and methods to invest in index funds.

- Missing financial plan and defined investment strategy – Yes, it’s a lot of effort to make one. Yes, it’s not easy. Yes, it’s something worth paying an independent financial advisor to do for you. Yes, it’s also worthwhile to learn how to do it yourself. I keep on harping on about this for good reason. It’s a big contributor to my long-term success and wealth creation. Read this post on what a financial plan should consist of, and download the sample for inspiration.

- Loss aversion to rebalance portfolios – It’s hard for investors to sell their entire portfolio of many, many individual investments to divert all their capital to a simple index fund portfolio. There may be losses to crystallise, and it’s hard to swallow the bitter pill. That’s a well-documented investor psychology called loss aversion.

- Too many investment products available – When you have hundreds and thousands of investments to choose from, selecting only a few may invoke decision paralysis. This is due to the paradox of having too many choices. So it’s intuitive for investors to think that having more types of investments is better, and it’s unintuitive to think that it can just be that simple (just invest in 1-3 index funds and that’s it). But in personal finance investing, simple is superior to complex or sophisticated

- FOMO – When you’re exposed to “news”, market updates, and watch the stock market every day, it’s easy to feel that you’re missing out on gains and the new investment trends. It can be hard to stay the course and maintain a long-term view. Don’t forget that it’s all just noise.

6. Frequently Asked Questions

Did you cherry-pick social media accounts with the most complicated portfolios?

No cherry picking. I chose accounts that showed the breakdown of their assets. Many had high-level categories instead of actual details, so that narrowed down the options.

I’ve chosen a range of portfolio sizes, from 4 to 7 figures, to showcase a diverse selection of examples.

It’s easy to keep it simple with five-figure portfolios, but once you have 7 figures, it gets more complicated!

What makes you think my simple Boglehead portfolio isn’t as large as the social media portfolios I’ve sampled? I have 100% conviction in the effectiveness of the simple Boglehead portfolio. Perhaps if/when I reach RM50m, I’ll reconsider other asset types for wealth preservation.

I don’t believe that even with a 7-figure portfolio, anyone needs to add any more complexity to their portfolio at all.

You’re seriously not investing/speculating in crypto? Gold? Property?

Nope, nope and nope. They’re not part of my investment strategy.

I’m making better returns with my active individual stock investments, crypto and gold.

Great! I’d love to see your total portfolio performance track record, including every single loss, transaction fees, etc. Then add a rough estimate of how much time you’ve spent on it. Did you generate reasonable alpha? Was the time expenditure worth it? Do you think you can consistently keep it up for 40 years? Sounds not only unlikely, but exhausting and stressful to me.

If yes, good for you. You’re a true snowflake. Remember, it’s easy to make bold claims during bull markets. Survive two real market crashes of more than 30% over 20 years, then reflect on your investment performance.

The last “real” prolonged market crash I’ve experienced was 16 years ago during the Great Financial Crisis. More recent crashes were a lot smaller and with very quick recoveries.

The problem is, only decades later do people realise their portfolio is underperforming. Why take that risk when you can make a guaranteed 10% over 40 years with no effort?

How can you claim that index fund returns are guaranteed? “Past performance does not guarantee future returns“

You’re likely mistaking returns of individual investments (e.g. stocks) vs investing in an entire market.

The statement is true for individual stock investments, but it is not necessarily accurate and is pretty much guaranteed for a broad-based index over the long term.

An individual stock’s performance is based on the underlying business performance. An investment class grows based on the fundamental principle of the asset class. For the world index, it’s pretty much the growth of the world’s production and innovation. The only way for the asset class to go upside down is if the world were apocalyptic. There are many larger problems to deal with in those instances.

I can’t guarantee that an index fund will be up tomorrow, or next week, or next year. But I’m pretty damn certain that in 20 years, it will be worth a lot more than what you initially invested. As long as you don’t touch it and reinvest the distributions.

Read my previous article analysing long-term returns and various asset class performances over the past 100 years.

If your investment time horizon is shorter (i.e. you need the funds in the next few years), you should be investing in more stable asset classes (as I also mentioned in the linked post above).

Public equities and index funds as an asset class are predicted to return only 4-5% in the future.

There are so many predictions like this, and none of them have come true.

If this scenario becomes true, that means the risk premium for equities as an asset class has decreased significantly. For example, if the risk-free rate is 3% p.a., then the equity risk premium would decrease from 9% p.a. (current returns of 12% – 3%) to 2% (new scenario returns of 5% – 3%).

The thing is, for that to be true, it means the risk premium for all other investment types will adjust downwards accordingly. The hierarchy of asset classes ranked by rate or returns is still preserved (e.g. FD < Bonds < Property < Equity).

So it doesn’t matter if that prediction will or will not happen. All rates are relative. Even inflation.

What if I have a very conservative risk profile?

That’s fine. If your risk profile is risk-averse, you should then assess whether index funds are right for you. Just make sure you’re not also in crypto, individual stocks, etc. Also, you can still keep a simple and boring portfolio with just 3-4 conservative investments. You don’t need 15 different Money Market Funds and commodity types.

Personal finance is personal; everyone is different. Morgan Housel says, “No one is crazy”

Be careful of misunderstanding his core message and misusing the phrase as a self-defence mechanism.

If everyone is truly different, then we need 7 billion different investment strategies.

Humans have created taxonomies, segmentations and frameworks to group things together. The reality is, we have more commonalities than differences.

- Everyone grew up with different experiences with money, but everyone has the same basic needs and expenses

- Everyone can choose differently what they like to spend their money on, but everyone should spend less than they earn

- Everyone has different levels of wealth, but everyone has the same basic needs and expenses

- Everyone has different levels of financial literacy, but everyone should have a common base level of knowledge

- Everyone has different income levels, but everyone should invest in their future

There’s a lot more in common than there are differences in personal finance, and having a simple, boring portfolio largely made up of a broad-based market index fund is something that 99% of individuals should adopt.

7. Closing thoughts

Investing gurus, finfluencers, and even some financial advisors like to keep portfolios complicated because it’s good for business, enables them to retain control and appears to project an aura of expertise.

But it’s too easy to make money with almost no effort by adopting a simple yet boring portfolio, which beats returns from most professional portfolios.

If it’s good for Warren Buffett to use in his will for his family (as he disclosed in a letter to Berkshire Hathaway shareholders in 2013), it’s good enough for you.

Simple is elegant.

Simple is effective.

Simple is the wealth meta.