Bankers are broadcasting their predictions that next year the S&P 500 will be 10% up.

Standard Chartered thinks that Bitcoin will rise to USD 200k in 2025.

Economists expect inflation to rise based on potential policies that Donald Trump may enact since winning the 2024 US election.

It’s that time of the year when everyone is going to offer their forecasts for 2025. Let me do the same.

I’ve done extensive analysis and built a 50-worksheet Excel model, taking into consideration current and future trends, government budgets and strategic actions of all OECD countries, the global geopolitical situation, and the state of technology advancement as a force multiplier.

My prediction for 2025

Can you guess what I have forecasted?

Based on all the information, news, current affairs, global trends, and the current valuations of stock markets, property, currency, crypto, and interest rates, I have predicted (extremely confidently) that IT DOES NOT MATTER.

Whatever hot topic is in the news, whatever prediction so-called experts make, such as bitcoin has surpassing USD 100k, or property is making a comeback, it is all just noise. Ignore it.

Whatever it is, it should have no bearing on your investments. It should not make you alter your course or change your investment decisions.

Why?

Two reasons why current market fluctuations and trending events don’t matter:

- In the long term, current events are just noise: In the span of your whole personal finance/investing lifetime, say 30-50 years, a market rally of 20% over 6 months, or a currency depreciation of 10% in 3 months should be a minor blimp, insignificant.

- You should have a solid, well-executed plan: Your investment and personal finance strategies should be impervious to short-term swings and volatility. If it’s not, you need to review your plan. Either you haven’t implemented enough safety margins (such as an emergency fund), or you’re trading/gambling, not investing. Perhaps both.

Let’s look at each one by one, in more detail.

1. In the long term, current events are just noise

The news might be shouting the end of the financial world as we know it. It might be a market crash, pandemic, wars, rising inflation, housing crisis… You see everyone panicking, cashing out, people are losing their jobs and there’s blood on the streets.

What does it mean for your investment portfolio?

The answer should be NOTHING. It does not matter in the long run.

Let me prove this point with an example.

- Imagine you started investing in the S&P 500 in 2006, and you’ve experienced some decent gains of about 20% by mid-2007.

- Over the next few months, you start reading the news that faulty mortgages are on the rise.

- Then, you watch a finance news channel which reports that lenders are starting to lose money

- A few months later, suddenly social media explodes with news that a USD 60 bn bank went bankrupt overnight

- Then the next day, you watch the market drop 20% in one day

- And it keeps dropping. The news keeps reporting that the market is crashing; Banks need rescuing, thousands of people losing their jobs, and nobody knows what’s going to happen.

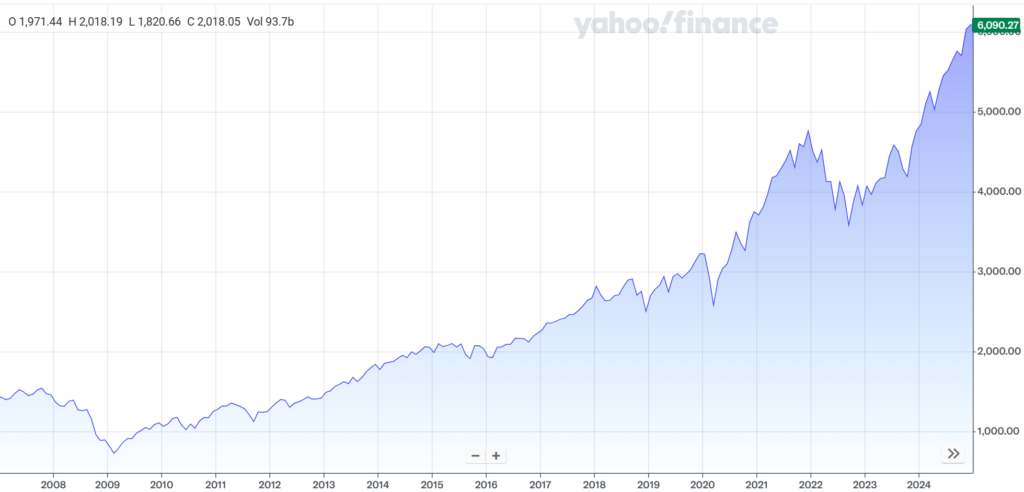

This scenario was happened in real life. The graph below (taken from Yahoo Finance), shows what happened to the S&P 500 which lost almost half of its value in about a year. This was known as the Global Financial Crisis (GFC):

Sounds really, really, scary right? Time to panic? Cash-out the other half of your investments? Many, many people did. If you were investing in that time, you were likely panicking yourself. If you originally had USD 500k at the peak, and it is now USD 250k, and it’s doom and gloom all around you, what would you have done?

Now, let’s see what happens over the next 15 years:

The graph shows the S&P 500 from 2006 until 2024. Can you see what happened?

- In 2009, the S&P 500 was still trending downward to a low of about 750

- But over the next few years, the market recovered

- And it has gained exponentially, increasing about 8x from the low in 2009 to now being over 6,000

How small was the market crash in 2008/09 compared to what has happened since? That’s right. It’s just a small blimp.

Yes, it’s easy to say this in hindsight. It’s hard to “stay the course” and not sell when people are rioting on the streets and losing their jobs.

So how do you build psychological resilience to the latest news about the financial world coming to an end, or FOMO in a bull-market?

2. You have a solid, well-executed plan

A well-designed financial plan should have the elements below, decided and implemented (non-exhaustive):

- SMART financial goals – your dreams, aspirations and objectives of what you want

- Emergency fund – Savings of about 6 – 12 months worth of monthly expenses put aside

- Insurance – to pay for medical bills, accidents, and so on

- Investment Policy Statement – your strategy for investing and portfolio allocation

How does having a well-executed plan help you ignore the noise?

Having solid financial goals plus an Investment Policy Statement means you have a clear strategy that you can adhere to: Why would the flavour of the week (crypto, inflation, AI boom, etc.) change your long-term investing plans? (By the way, I’m assuming your investment strategy does not involve investing in individual stocks, which 99% of people should not be doing. Stick to broad-based index funds).

Your goals and investment strategy help you focus and gain confidence to stick to a specific investing path.

You’ll definitely need to review your plan periodically, but it should not be swayed by current hot topics. It should be adjusted based on your circumstances, not external circumstances. For example, a change in job and income, additional dependents, change in lifestyle preferences leading to a change in expenses, etc.

Having an emergency fund and insurance gives you buffers, or a safety net, in case of unfortunate incidents. Many investors end up changing their investment strategy, or selling out at the worst times (market lows) not because they want to, but because they are forced to.

It’s easy to think “If the market crashes, I can hold on. I don’t need the money”.

But an under-appreciated law of nature is bad things always come together.

- A tech bubble bursting means that the stock market will crash.

- Investors get jittery and pull out their capital.

- Funding dries up and startups go under.

- People lose their jobs and struggle to pay their mortgages.

- Unemployment rises and banks get stricter on lending.

- People use up whatever minimal savings they have, if any.

- Mortgages default. Foreclosure auctions rise. Housing prices crash.

- People are forced to sell their investment portfolios.

Ask yourself, “How long can I weather a stock market crash if I lose my job, inflation is at an all-time high, my mortgage has doubled due to interest rate rises, and my ageing parents need to be hospitalised and they don’t have insurance”?

Make sure your emergency fund, insurance and other aspects of your financial plan account for many, many bad events happening at the same time.

Key takeaways

No one can predict the future.

Everyone has an opinion, and no one is held accountable for their predictions that ends up being incorrect more often than not. Ignore all forecasts and predictions of the (short-term) future, and focus on things within your control that help you in the long term (your savings rate, income progression, financial planning and risk management).

All media content (traditional and social media) is designed to steal your attention.

Their performance is based on visits, clicks and active followers/readers, measured daily, weekly and monthly. As a result, their content is all sensational headlines and dramatized content, tailored to spike your interest, but actually mean nothing in the long term.

Try this experiment: Stop reading the news and social media for a few months. With all that time you’ve saved, read actual books. Don’t know what to read? Start with my recommended reading list. Did you miss out on anything life-changing by detoxing on the news and social media? With all that reading, did you learn anything life-changing?

In the long term, the foundations of investing and creating wealth matter more than anything else.

Stop looking for the latest investment fad, or overcomplicating your finances. The true masters of any field spend most of their time perfecting the basics and building a solid foundation, not devising advanced and complicated strategies. Most people look for something new and shiny because they’re bored.

But personal finance is meant to be boring. And doing the boring things well is what matters in personal finance.