Finite human resources: Effectively managing your time and attention

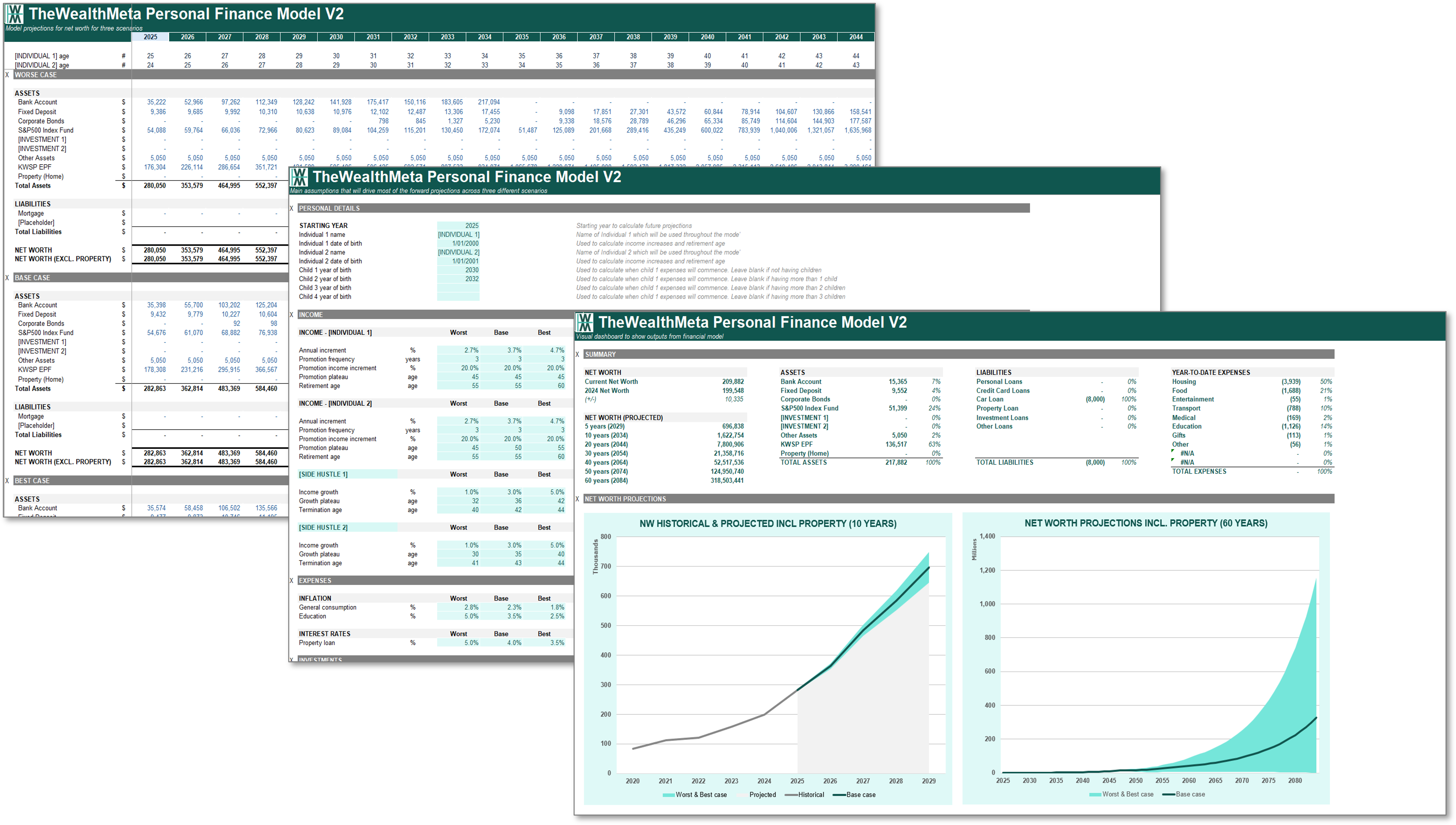

Anyone who thinks that you can have infinite growth in a finite environment is either a madman or an economist.David Attenborough Key takeaways We only have a limited amount of time and attention Not all activities deliver equal or even valuable impact; where you spend your time and attention matters The most impactful wealth-building activities are Having the right partner Following a plan Mastering your money psychology Growing your primary income Most people, when choosing to engage in financial activities,…