This post is a continuation of my Developing your Financial Plan Series. In my previous post, I talked about how to set SMART financial goals. As a recap, financial goals can be anything you want them to be, as long as they’re Specific, Measurable, Achievable, Relevant and Time-bound.

Hopefully, you’ve taken some time to write down a few SMART financial goals. Don’t worry, you can always add or refine your goals as your situation evolves.

In this post, I’ll cover what to do with those SMART financial goals.

What you will learn in this post

You will learn:

- How financial goals translate into budget and saving targets

- How to calculate required monthly savings, based on financial goals

- Understanding how each goal’s timeframe drives savings and investment vehicle choices

Your financial goals determine the amount you need to save (and invest)

So, you’ve set your SMART financial goals and are now thinking “Great, what do I do next? How do I translate these goals into other parts of my financial plan?”

Most of you may already know the simple answer which is: “I just need to save a portion of my income every month until I hit those financial goals“.

Great starting point. Now, some of you may be wondering? How much do I need to save each month?

I bet those of you with some budgeting experience are thinking, “That’s easy, I just divide the amount I need to save for each goal by the number of months before I need to spend that money. Then add each of these monthly savings for each goal together to know how much I need to save each month”.

So for each goal:

- Goal 1 savings p.m. = (Goal 1 amount) / (months until Goal 1)

- Goal 2 savings p.m. = (Goal 2 amount) / (months until Goal 2)

- …

- Goal [N] savings p.m. = (Goal [N] amount) / (months until Goal [N])

And so on, then you add them all together:

Total monthly savings required = (Goal 1 savings p.m.) + (Goal 2 savings p.m.) + … + (Goal [N] savings p.m.)

Remember in the post in which I wrote about the secret to creating wealth, I mentioned that the two key levers are your savings rate and investment rate? Well, there’s one more lever which is really important. As you can see from calculating your monthly savings above, the third key lever is time:

- The amount of time you have to hit your goals determines the amount you need to save each month/year

- The more time you have, the more you’re able to reduce the monthly savings amount required

That’s one of the reasons why it’s important to start saving and investing early. Time is the biggest lever out of all three which will drive the most impact. Because the more time you have, the more you can spread out your savings, and also let compound interest do its thing.

How I think about my financial goals, savings and expenses

I think about designing my financial needs in 4 different buckets:

- Monthly expenses: Typical ongoing expenses such as rent, food, utilities, entertainment, and so on. Basically costs which I will incur on a monthly basis, needed to go about my day/week/month.

- Lumpy expenses:

- Expenses which are periodic but infrequent. They don’t occur on a month-to-month basis, but are predictable and come at least once a year. This is where you start thinking of expenses on an annual basis instead of a monthly basis.

- Examples are car and home maintenance, school fees, holidays, gifts and so on

- Savings

- These are for larger expenses that I may need to purchase in more than a year, but not far enough in the future that I could put the money into investments. For me, these are generally purchases 2-5 years away

- Examples are a big holiday, car, home renovation, wedding, etc.

- Long-term goals:

- Large expenses which require a significant amount of funds belong here

- Examples are retirement, children’s education, medical expenses, aged care needs, philanthropy / trusts, and so on.

- These expenses will only be needed decades away, so there is time to accumulate money for these goals. The problem is, that the majority of people ignore this bucket until it’s too late.

This may or may not work for you, but I think it’s a good way to think about immediate expenses vs longer-term savings goals.

Example of calculating expenses, savings and long-term goals into monthly targets

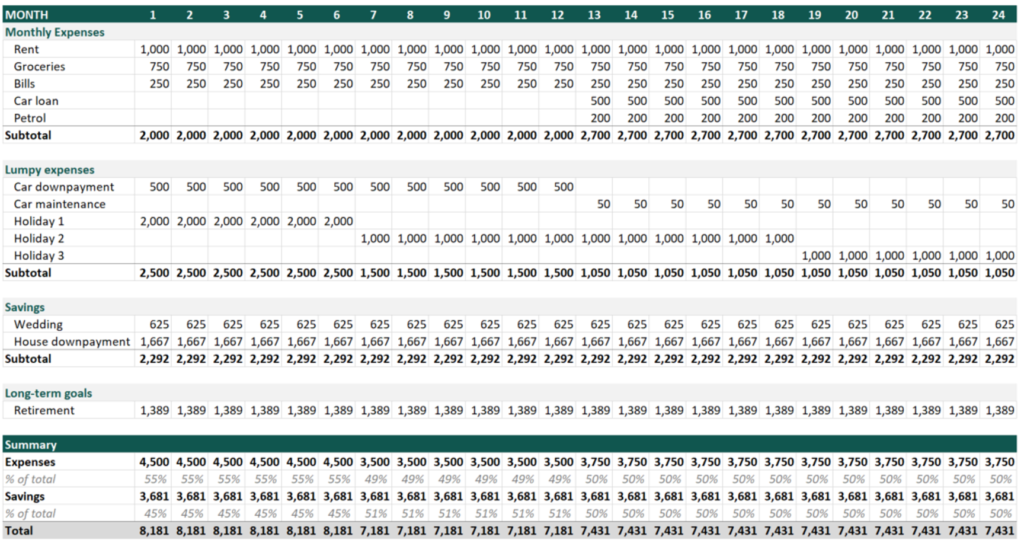

Let’s take an example of what this might look like with some example financial goals:

- Expenses

- Monthly expenses: Rent ($1,000), groceries ($750), bills ($250), car loan repayments ($500) and petrol ($200) once a car is purchased

- Lumpy expenses

- Car down payment of $6,000 in 1 year ($500 p.m.)

- Car maintenance of $300 every 6 months ($50 p.m.)

- First holiday for $12,000 in 6 months ($2,000 p.m.), with $12,000 for every annual holiday thereafter ($1,000 p.m.)

- Savings

- Wedding in 4 years for $30,000 ($625 p.m.)

- House down payment of $100,000 in 5 years ($1,667 p.m.)

- Long-term goals

- Retire with $500,000 in 30 years ($1,389 p.m.)

This is what your expenses and savings would look like in the first 2 years:

Some notes on the example:

- For simplicity, the example doesn’t include any existing savings/cash

- Always add some buffer to your estimations, so you don’t end up short-changed

- For all financial goals, I recommend to start saving right now. You could postpone some goals until later, but you risk not saving up for it. Lifestyle creep additional expenses and unforeseen circumstances will always come up

- Inflation has not been included in the example. For short-term goals, inflation is not a factor. The further into the future the goal, the more important it is to think about inflation. The cost of a dream car in 10 years may be quite different from the cost of a car in a year. I’ll cover how to include inflation in another post

- Investment returns are not included, from any money that may have been invested in the long-term goals category. It deserves a post on its own

As a start, I strongly recommend building a spreadsheet like this for at least 2 – 5 years, which at a minimum covers your monthly expenses, lumpy expenses and savings (meaning your short-term and medium-term goals). You could also include long-term savings now or once you learn how to include inflation and investment return rates which allows you to get a more accurate picture (more on that in future posts).

This is where you’ll need to start building your spreadsheet skills. As you continue to refine and put more detail into your financial goals, your personal finance spreadsheet will start to get more sophisticated.

Let’s go back to a more immediate question. What do I do with the 4 buckets of my financial goals translated into expenses and savings? You need to decide where to put the money you’re saving each month.

The timeframe of your financial goals determines where you have or invest your money

The quick answer is, that the timeframe in which you need the money determines the safety of the financial instrument/vehicle in which you park your money. The general principle you want to follow is:

The shorter the duration for which you need the money, the safer the financial vehicle. Putting money you need in the short-term into a risky investment does not allow sufficient time to recover your money in a situation such as a market crash

Typically I do something similar to what I describe below (which is somewhat simplified):

- Monthly expenses: Just in my current bank account. Straightforward

- Lumpy expenses: Another normal bank account or high-interest savings account

- Savings: High-interest savings account, bonds or money market fund. Generally still low-risk but higher yield investment vehicles

- Long-term savings: Investment vehicles with consistent, predictable returns in the long term. I’m a Boglehead, so that means broad-based diversified index funds

Frequently Asked Questions

Shouldn’t I figure out my savings rate based on what I’m earning and how much I could save each month first i.e. savings rate, and then only work out what goals I could achieve?

Sure, you could. But then, you’re prioritising paying others first (rent, utilities, etc.) instead of paying yourself first (medium and long-term investing needs). I believe this limits your potential to aim higher, as you don’t get a view of how much you actually need to save and invest to reach loftier goals.

Also, it’s easy to get sucked into immediate needs/wants and delay longer-term goals. Don’t forget, one of my 21 principles of financial independence is to always pay yourself first. As we progress through this Financial Planning series to budgeting and forecasting topics, I’ll cover how to find the right balance between spending and saving/investing.

Won’t I get better investment returns for the money which I need to save for something in 3-5 years if I invest in an index fund /stock market? 5 years is a lot of time to recover from any crash.

You may think so, but statistics show that a typical market cycle (average time between each market crash) is about 6.25 years. Yes, I know that statistics also show that the average time for a market to recover after a crash is about 3-4 years. What if the market crashed in the 4th year of your 5-year goal to buy a house? You might have to wait another 3-4 years and accumulate more money, pushing back other goals as well. Are you willing to take that risk just to get say 2-3% additional returns over those 5 years? Do the math, and decide for yourself if you’re willing to take that risk.

Conclusion

As you start to calculate how much you need to save each month to hit your goals, you might notice that you need to save A LOT, even if you’re young and have 30 years to hit some of your goals. It might seem impossible to hit.

However, we have yet to include 2 key factors that will help us meet our goals: investing returns (which I mentioned in the example) and income appreciation. I’ll write more about incorporating both factors in the forecasting cash flows topic coming soon.