I first started tracking my finances after I finished university in 2007 when I was broke and unemployed.

My net worth when I started? About negative AUD 1,300.

Since then, I have used many methods and tools to track my finances. There isn’t a “right” way to do it, but you need to ensure it serves its purpose: To give you a reasonably accurate picture of your wealth and financial performance.

What you will learn in this post

Previously I talked about why it is important to track your finances.

In this post, you will learn

- What items are tracked in a personal finance Balance Sheet and Income Statement

- How to calculate your net worth (it’s not always as straightforward as it seems)

- What are the process/steps to track your finances

- How often should you track your finances

- Tools that you can use to track your finances

- How I choose to track my finances

The Balance Sheet and Income Statement are typically used to track your cash flow and net worth

If you’ve read my previous post about personal finance statements, you’ll know the concepts of a Balance Sheet and an Income statement.

Quick recap :

A Balance Sheet is a snapshot of your wealth at a specific point in time, detailing your assets, liabilities, and net worth (equity)

An Income Statement is a summary of your income and expenses over a specific period, resulting in your “net profit” (income minus expenses).

You are “tracking your finances” when you update these two personal finance statements. The Balance Sheet tracks your net worth, the Income Statement tracks your income, expenses and savings.

In terms of measuring the performance of your investments, this can start to get a bit more technical and deserves a future post of its own. For now, what you want to track for your investments are how much you have invested (capital contributions) and the current market value (which forms part of your net worth / Balance Sheet)

What items do you record in a Balance Sheet?

Assets: the simple answer is, everything you own that has a market or resale value. These are typically (non-exhaustive)

- Cash and equivalents: Physical cash, bank accounts, fixed deposits

- Investments: Stocks, funds, and bonds

- Retirement accounts: Provident Funds, Superannuation funds, private pensions, 401k and IRAs

- Property: Residential, commercial, industrial, or even just land titles

- Vehicles: Cars, bikes, yachts

- Valuables: Rare jewellery, gold, rare collectables

- Intangible assets: Assets which are not financial instruments or physical, such as patents, royalties, licensing rights, and so on

Liabilities: the balance amounts remaining you owe to others

- Home loans

- Car loans

- Student loans

- Personal loans

- Credit card debt

- Borrowing from friends and family

- Equity loans

All you need to do is list them down and add them together, with the difference being your net worth. This represents how much you’re worth after you’ve paid off all your debts.

Never have a negative net worth. Ever.

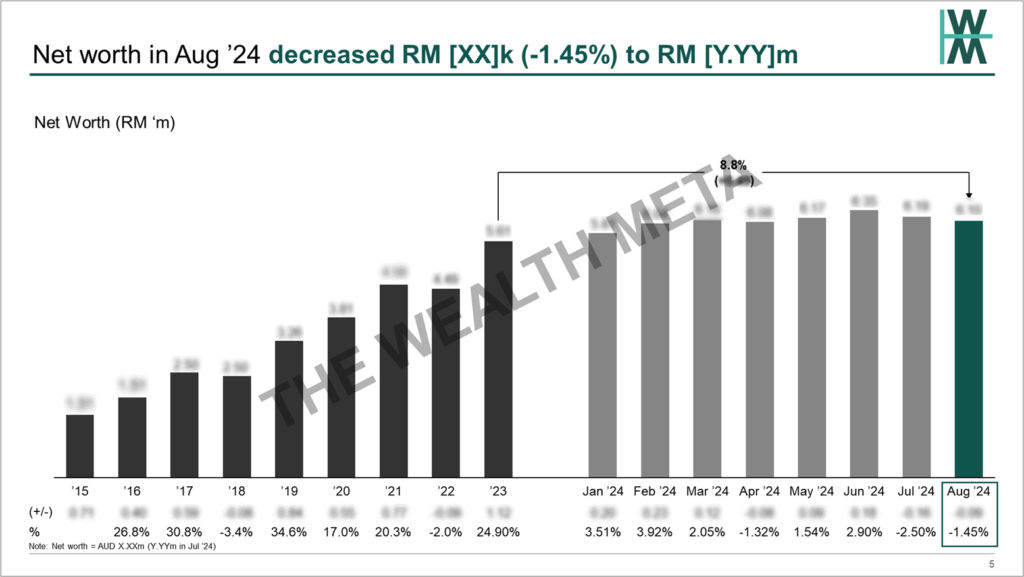

Below is a sample of my net worth tracking over time (no point showing the breakdown, it’s pretty straightforward).

Do I count my own home as an Asset?

Technically, you should count everything. Some people argue not to include it, as you don’t make money from it unless you sell the house.

Many people interpret how to calculate net worth differently.

In reality, why not do both? Just have two net worth numbers. A “Grand Total” net worth figure, and an “investment net worth” figure, where I only count assets that I can use to spend and generate income from (all investment assets, cash and equivalents in bank accounts). This gives me a total picture of my whole value, and then another figure which tells me how much investments I have w and it’s potential to grow and cover my expenses (financial independence).

In summary, you should always at least track one type of net worth figure that helps align with your goals (for example, for those with FIRE targets, investment and retirement assets only without the home).

What about cars, valuables and other smaller items?

It’s really up to you. I only listed them above to be holistic. I personally don’t track any of that, it’s too small/miniscule and not part of my investments.

What items do you record in an Income Statement?

Income: All your earnings over a particular period

- Gross salary and bonuses

- Allowances

- Dividends from business or stock ownership

- Distributions from mutual funds and similar managed investments

- Trading income and capital gains

- Interest earned from bank accounts, FDs, bonds

- Annuities

- Royalties

- Inheritance and gifts

Expenses: All types of spending over a particular period

- Typical expenses (food, housing, bills, entertainment)

- Interest payments on loans

- Capital losses

- Insurance premiums

- Taxes (yes, you should track this)

- Gifts and donations

All you need to do is list down all income and expenses for a specified time period (typically monthly). Then subtract income from expenses and you’ll have your net profit. Typically, your net profit is how much you have saved.

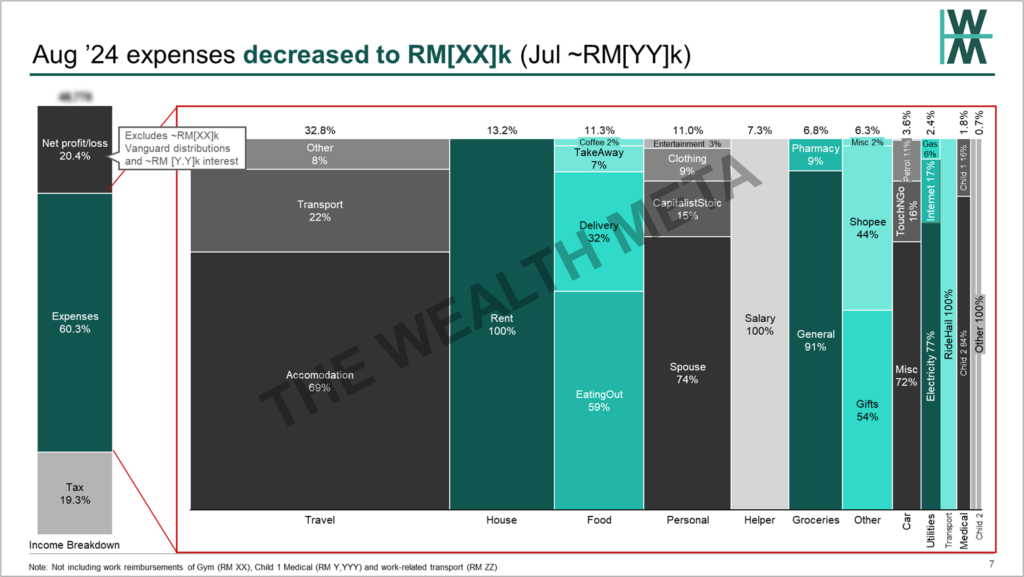

Below is a sample of what my version of tracking my income and expenses looks like:

How often should I record / track my finances?

Most people track their net worth monthly, although it is fine to do quarterly or yearly, especially once you’ve accumulated a significant amount of wealth.

For income and expense transactions, this requires a lot more effort since you’ll have transactions daily. Some people do it every day, and some do it weekly or monthly (meaning recording all transactions in one go for the previous week or month).

Any frequency should be fine as long as it’s not longer than a month and you’re reasonably accurate in capturing all the transactions.

Frequently Asked Questions

Do I really have to track every single transaction for the income statement?

Yes. No ifs and no buts. Humans are extremely bad at estimating finances and how much they spend. It’s very similar to people who fail to lose weight and claim they don’t eat much. Track every calorie, track every expense.

Do I really, really need to track every single transaction, forever?

It’s totally up to you. But what gets tracked, gets measured. If you are struggling with saving money each month, and have no idea where your money is going, then you definitely need to track.

I highly recommend that everyone tracks expenses for at least a year. Some people think a quarter is fine, but there are too many lumpy transactions that happen in different quarters. Plus, as you get more sophisticated, you start thinking of your finances and expenses in yearly periods, not monthly or weekly.

Tracking your expenses for at least a year gives you a grasp on how to plan your budget for the next year, as you’ll have a whole year’s worth of data.

But really, tracking your expenses shouldn’t take much effort anymore, as everything is digitised. You can extract data from your online banking systems and bank account statements, so you’re not manually writing down every transaction.

How do I handle cash transactions? If I don’t write it down on the spot, when I count how much cash I have vs what I spent it never matches! Sometimes it still happens when I instantly record the cash expense!

We live in a digital payments age. Your physical cash transactions should be almost non-existent. I go months without touching a single cash note or coin.

The process is much simpler once all your expenses are done through credit cards and digital payments. Also, try to minimise the number of e-wallets and credit cards. I only have one credit card, and don’t use any e-wallets. For me, the “points and discounts” are not worth sacrificing simplicity.

So if rarely use physical cash, just treat each “withdrawal” as an expense. For example, if I withdraw 200 dollars, I record the expense as “Cash: 200” even though I haven’t spent it yet.

Then I don’t bother recording any physical cash expenses until I withdraw more cash which might be 4 months later. Why waste time tracking a physical cash payment of 4 dollars at a parking lot if I barely use cash? Just lump it all together for your peace of mind.

I noticed you look at gross salary, and include deductions such as tax. Why can’t I just record my “take home salary”, meaning the amount of salary I receive in my bank account, less taxes and other deductions? Why should I track gross salary, taxes and how much goes into my retirement accounts?

Well if you do, you’re missing out on many strategies to maximise wealth. Remember, gets tracked gets managed.

If you’re not tracking taxes as expenses, then you’re not thinking enough about how you can minimise tax.

If you’re not tracking deductions to retirement accounts, then you’re not thinking enough about wealth creation and retirement strategies (such as employer match for 401Ks, salary sacrifice for Superannuation, or minimising taxable income by increasing employer contributions to EPF).

If that “savings rate” number bothers you when you use gross salary and have a tax component, then just have multiple saving rate figures, just like how I suggest having two different net worth figures.

What tools/software should I use to track my finances?

There are many tools out there. Old-school die-hards may even use pen and paper. Some have it fully automated in Empower or Mint Capital.

For most people, Excel is the best. Highly customizable, flexor and you keep all the data in your own storage (private and secure).

What is most important is what works for you and that you’re comfortable using.

However, I think as most people become more financially literate and savvy, they gravitate to Excel as you can customise it to your liking.

I also highly recommend using Excel as you can incorporate your Financial Plan and forecasting models, calculators and other tools all into one Excel file.

How I track my finances

I’m a little too nerdy and a control freak. If you knew my net worth you would be scratching your head as to why I do it this way. But this is the system that I like.

The tools I use to track my finances

- Excel: The granddaddy of it all. Learn it. Master it. All my future how-to and tutorials will be in Excel, so you better learn it.

- Beancount: This is the “core” where I store all my finances. Beancount is a plain-text accounting software. Why do I use it instead of YNAB, GnuCash or any other platform?

- It’s open source, free (download from Github here), and digests data from a plain text file which pretty much contains double-entry accounting transactions and historical fund prices and FX rates

- I run it on my own home server set-up using Docker and Proxmox (for your home server geeks)

- Fava: A front-end platform that connects with Beancount to serve all my financial data in a web-based interface. I also run on Fava in my home setup, and I can access it from any browser anywhere in the world. Go have a look at the online demo, it’s great.

- Powerpoint: Most people have some kind of spreadsheet dashboard (I kind of still do), I prefer PowerPoint charts to report on my finances. Because I’m a consultant by trade. I also use it to discuss finances with my spouse.

The process steps I run to track my finances

At the beginning of every month:

- Update Beancount with the previous month’s data

- Download my credit card statement PDF for the previous month

- Import the transactions into an Excel template that transforms the data into a format that Beancount can digest

- Login to all my Internet banking accounts, update Beancount using Fava’s web interface with banking transactions for the previous month (manually, there shouldn’t be too many)

- Repeat with fund prices and FX rates as at the end of the previous month

- Beancount is now updated

- Update my Excel personal finance model and prepare a PowerPoint report

- Extract data from Beancount into CSV and import into Excel personal finance model

- Existing datasets and charts are automatically updated in the Excel file

- Update PowerPoint reports based on updated charts and tables for Excel

- Update outstanding items with the latest progress updates

- Conduct monthly money/finance talk with partner

- Discuss Powerpoint report with partner

- Discuss any new actions that need to taken, and the progress of existing actions

At the beginning of every year:

- Repeat the same process, however reports are prepared to cover the whole year that ended

- Review financial plan and discuss/develop goals for the new year

Bonus: Download example monthly finance report

Want to see what my monthly Powerpoint report looks like? Download a copy here. A bit unconventional vs your typical Excel Dashboard or other personal finance software, but I’m a management consultant by trade so I like Powerpoint.

Over the years, I’ve simplified my reporting / tracking in Powerpoint to focus on the key information and messages to review on a monthly basis. Any other important information is already automated as a part of my Financial Plan.

Conclusion

Some time in the future I might provide a more in-depth tutorial on how to create your own Excel finance tracking tool (and maybe even Powerpoint). Let me know if you feel this is something that will be of value.

Now that you know what to track and how to track, the next step is learning how to create a financial plan. To do that, you first need to come up with SMART financial goals.